Many facilities often have miscellaneous revenue that doesn't always fit into a preset category like retail or rent. Your software has Miscellaneous Revenue settings that help you keep track of miscellaneous charges. You'll find this setting in the Corporate section of your software.

This article is intended to assist you in:

- Adjusting Miscellaneous Revenue settings

- Adding Miscellaneous Revenue charges

- Viewing Miscellaneous Revenue details in reports

Adjusting Miscellaneous Revenue settings

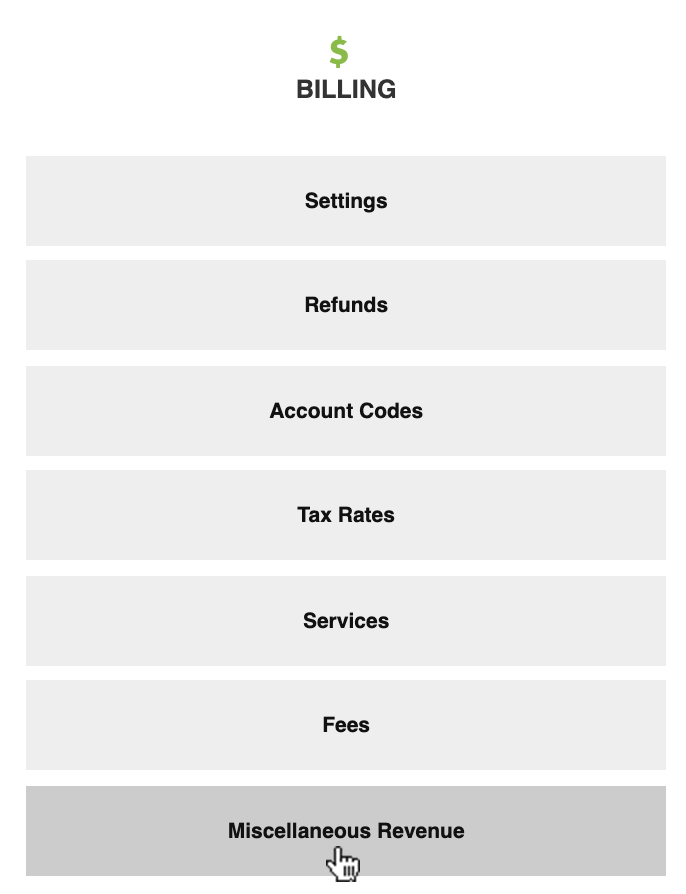

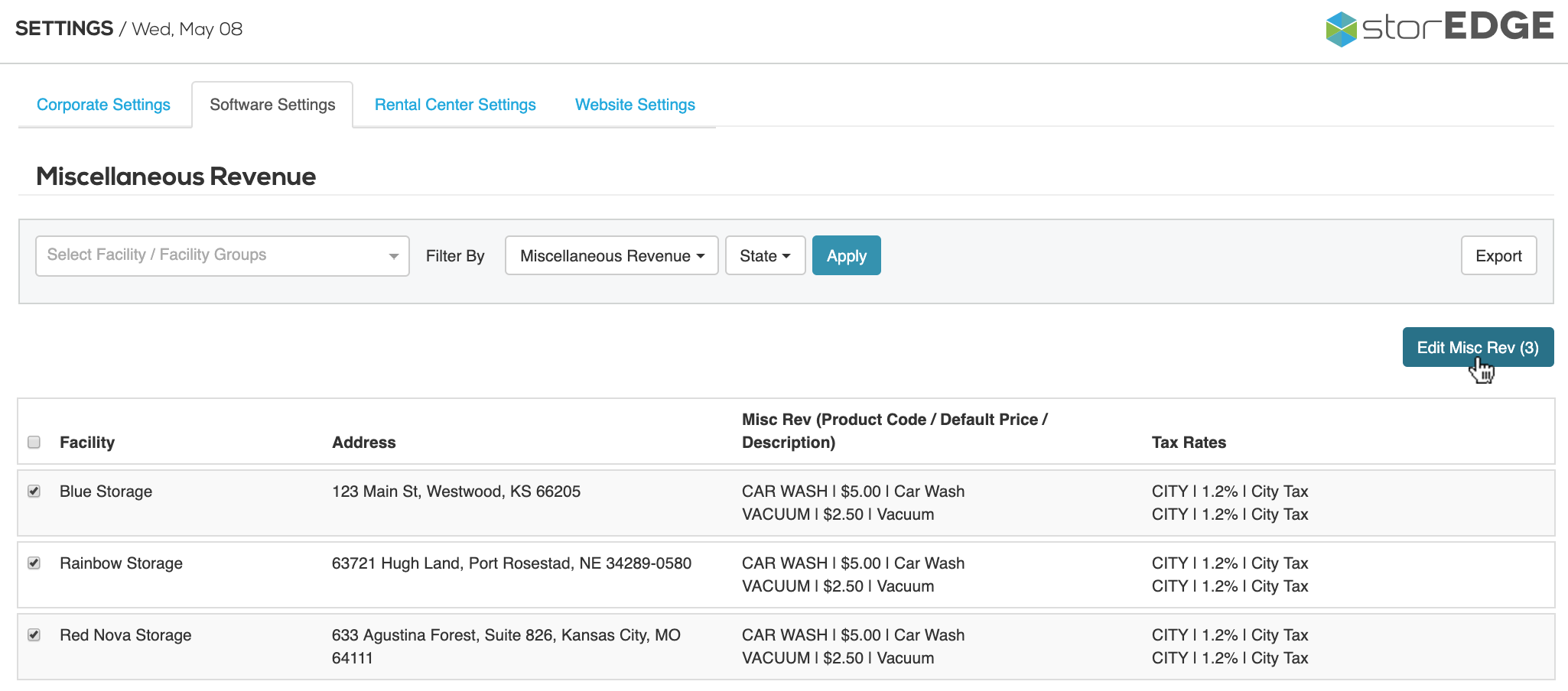

To access your settings, you can click the Edit Corporate Miscellaneous Revenue from your facility-level Miscellaneous Revenue settings to take you to the Corporate section. Alternatively, from the Corporate section, you can access your Corporate level Software Settings tab and find Miscellaneous Revenue under the Billing heading.

The next screen will show you a list of your facilities (if you have more than one) and display the facility name, address, any miscellaneous revenue you have setup at your facility, and the tax rate that is associated with that item.

To edit your settings, check the box next to the facility or facilities that you’d like to adjust and click Edit Misc Rev.

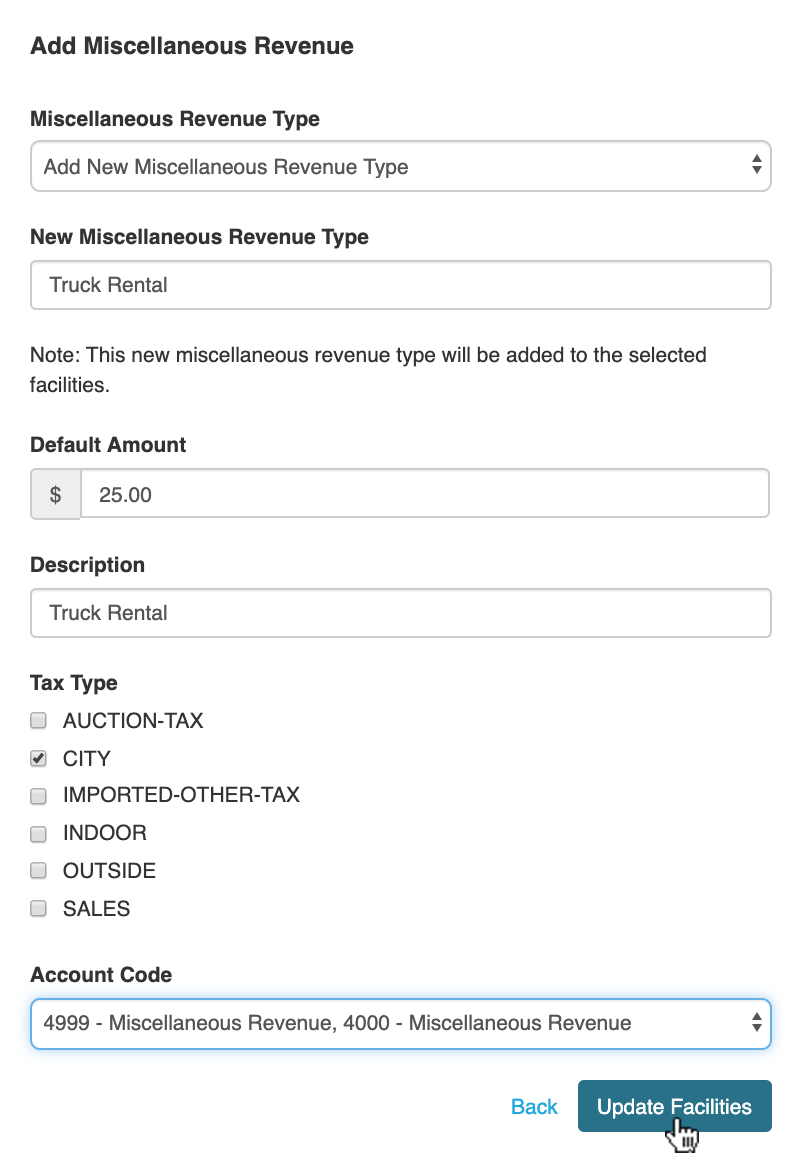

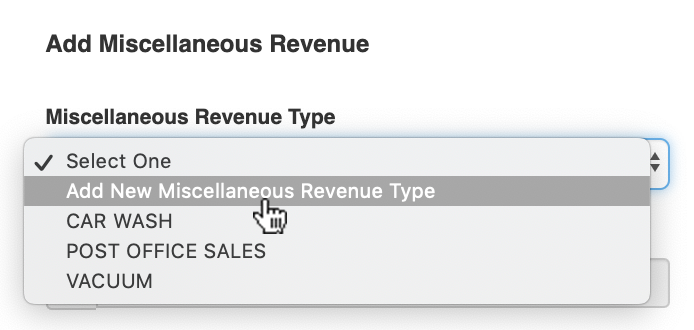

The next page allows you to make your adjustments. To add a new Miscellaneous Revenue type, click the dropdown under Miscellaneous Revenue Type. From here, select the item you’d like to edit or select Add New Miscellaneous Revenue Type to add a new type.

Next, enter the details of your miscellaneous revenue type. Add a name for the type and the default amount for the charge, and a description. Last, select a tax type and an account code.

After you’re finished adding or editing the miscellaneous revenue type, select Update Facilities to save your changes.

Adding miscellaneous charges

There are several ways to add misc revenue in your software:

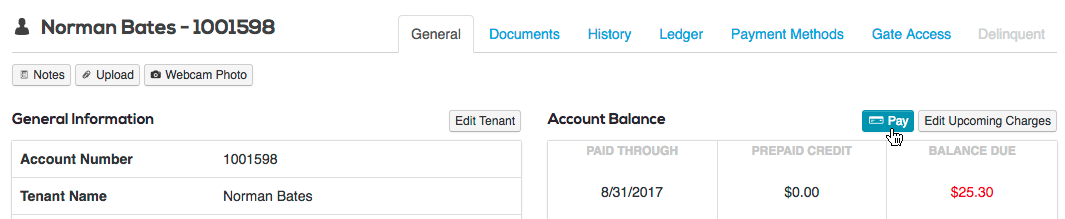

Adding a misc charge from the General tab on the tenant page

To add charges tagged as misc revenue, click the Pay button on the tenant page.

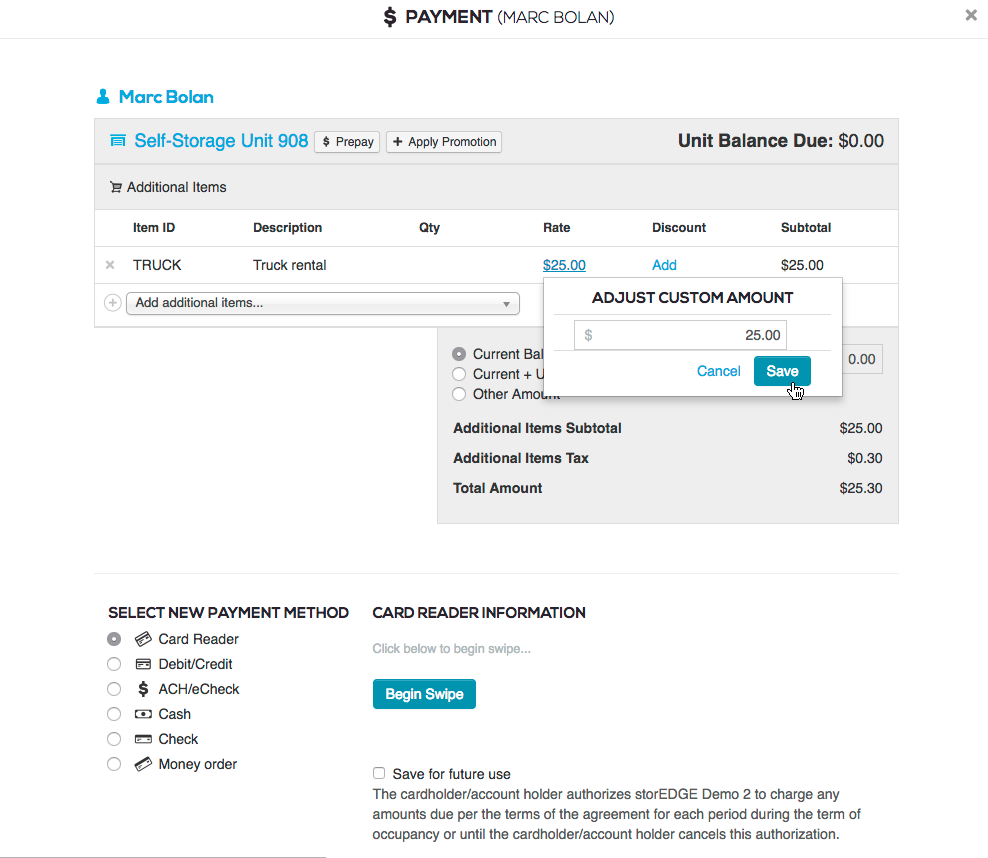

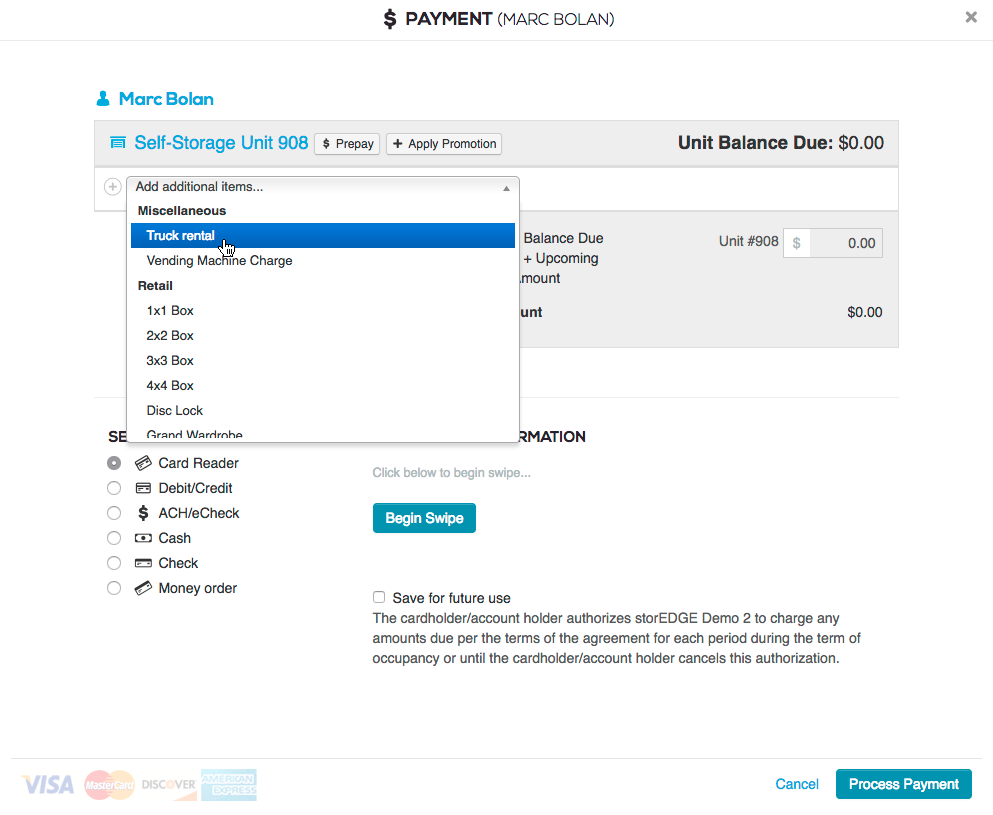

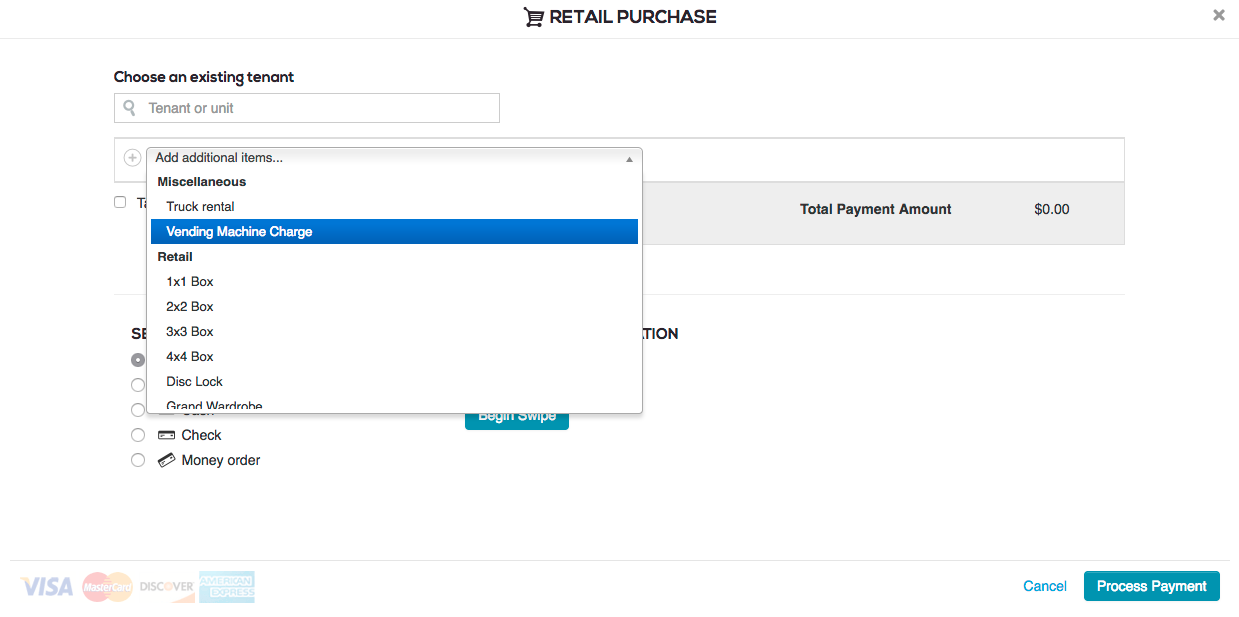

Select the Add additional items drop down. All Misc Revenue items you've created will appear in the list above your facility's retail items. Select the desired misc item.

If the rate you previously set in your Miscellaneous Revenue settings is not the rate you'd like to charge, click the rate. It will appear as a hyperlink. From here, the Adjust Custom Amount window will open, where you'll have the opportunity to change the rate to whatever you wish. Once you've entered your desired rate, select Save. You can now go through the rest of the payment process, and the charge will be attributed to misc revenue.

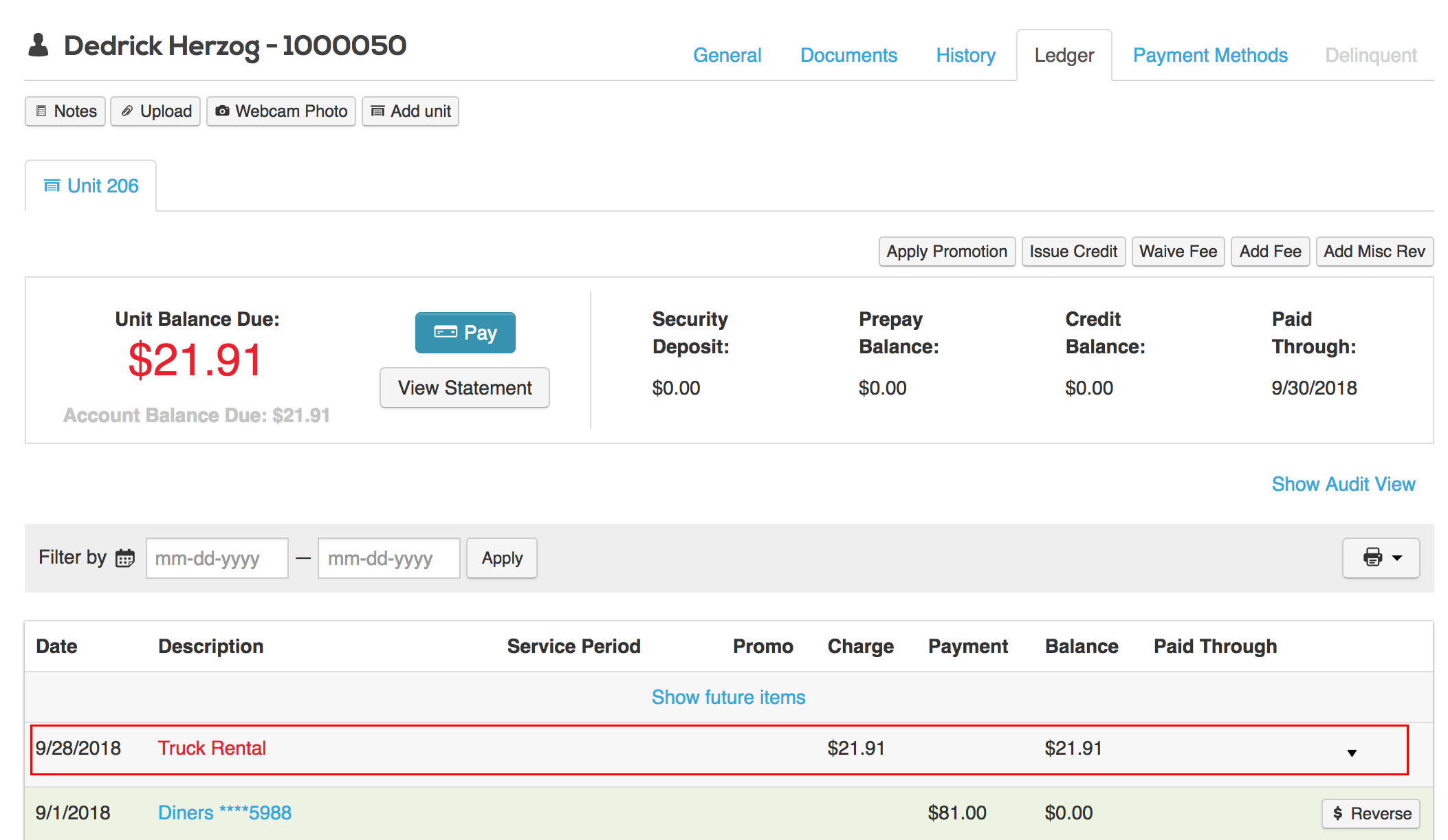

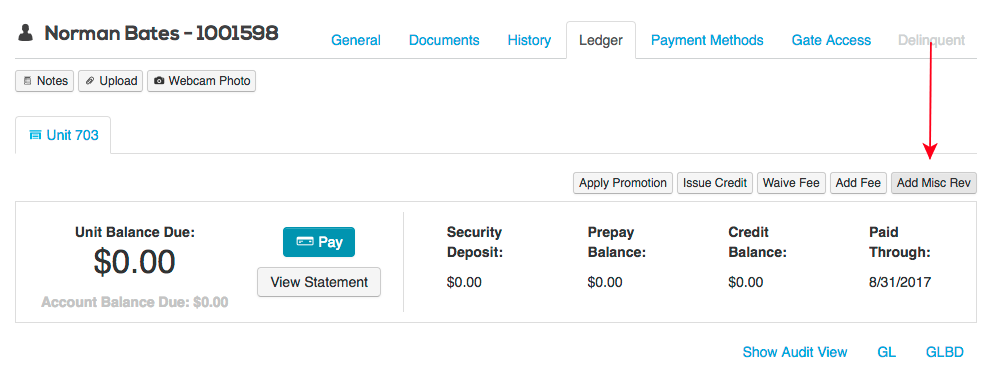

Adding a misc charge from the Tenant Ledger

Adding a charge from a tenant's ledger is a good way to add a charge that is to be paid at a later date. To add a charge from the tenant ledger, access the Ledger tab on the tenant page. Select the Add Misc Rev button next to the Add Fee button.

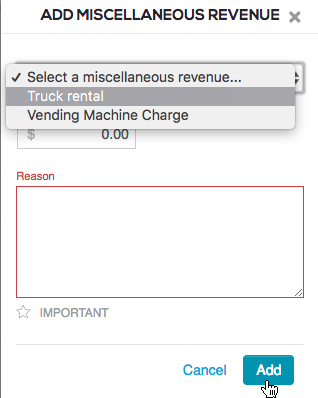

A window will open with a drop-down list of your misc categories. Select the misc item, add the amount of the charge, add a reason, and click Add.

The misc charge will then appear on the tenant's ledger and on a new invoice.

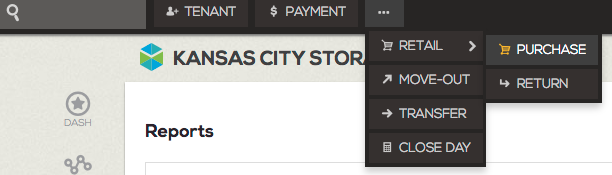

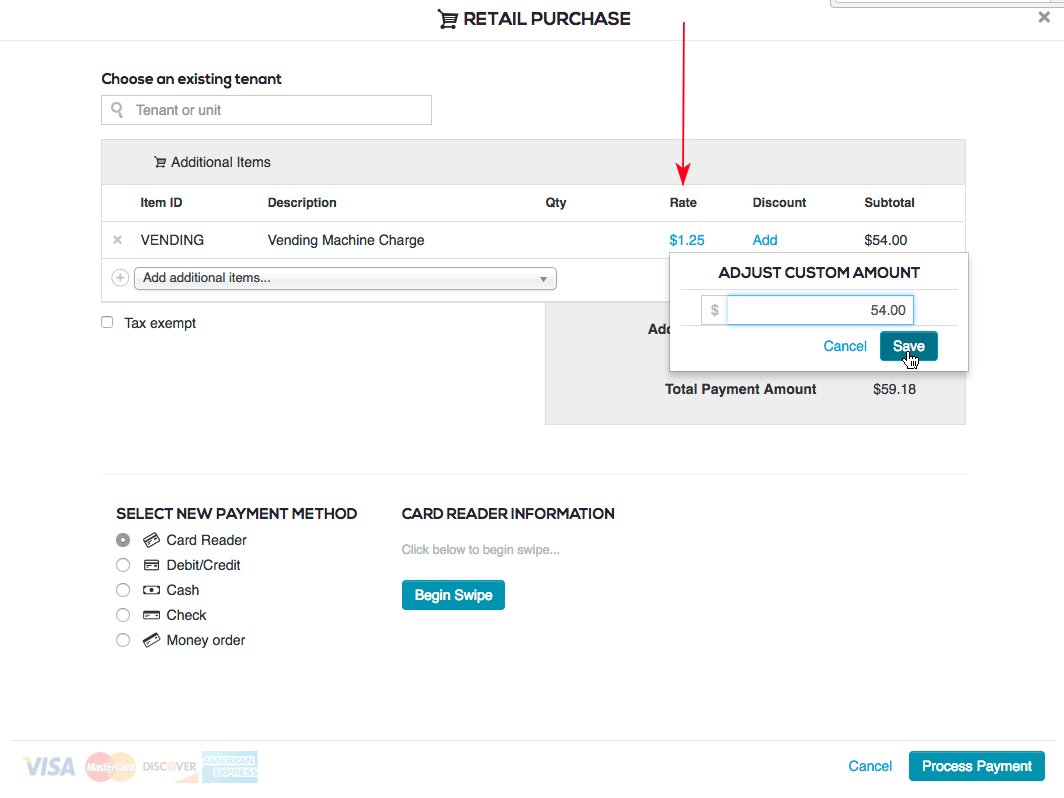

Adding a misc charge from the Retail Purchase modal

If you have miscellaneous revenue that is not necessarily tied to a tenant, such as vending machine revenue, you can add it by clicking the ... button at the top of your screen next to the Payment button. Hover your mouse over Retail, and select Purchase when the window expands.

The Retail Purchase window will open. Click the Add additional items drop-down and select the desired misc item.

Enter the amount of the revenue and click the rate amount. Adjust the amount to the incoming revenue amount, click save, and finish processing the payment. You can learn more about processing payments on our help site.

Viewing Miscellaneous Revenue details in Reports

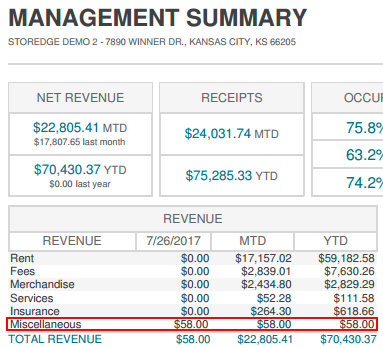

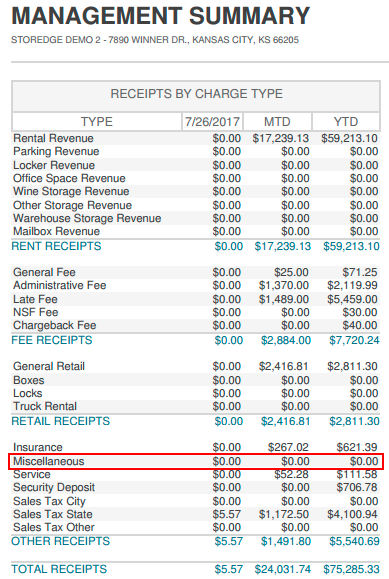

You can view your total daily, monthly and yearly misc revenue charges on the Management Summary report in the Revenue section and in the Other Receipts section.

Additionally, misc revenue details appear on the Rent Roll report under the Other Due column.